カリフォルニア州サンタクララ - 2021年5月6日木曜日 - 半導体エコシステム向けの包括的データソリューションのリーディングプロバイダーであるPDFソリューションズ社(Nasdaq: PDFS)は本日、2021年3月31日締めの第1四半期決算を発表しました。

ビジネスハイライト

- 総収益は2,420万ドル、前年同期比14%増

- アナリティクスの売上高は1,940万ドル、前年同期比46%増

- アナリティクス収益が総収益の80%を占める

- GAAPベースの売上総利益率56

- 非GAAPベースの粗利益率61

- 営業活動による現金支出は830万ドル

- 450万ドルの自社株買い戻し

- 現金、現金同等物および短期投資1億3,230万ドルで当四半期を終了。

- 通年では、アナリティクスの売上高は年間目標成長率20%を上回り、総売上高は年間成長率20%に近づくと予想している。

2021年第1四半期決算ハイライト

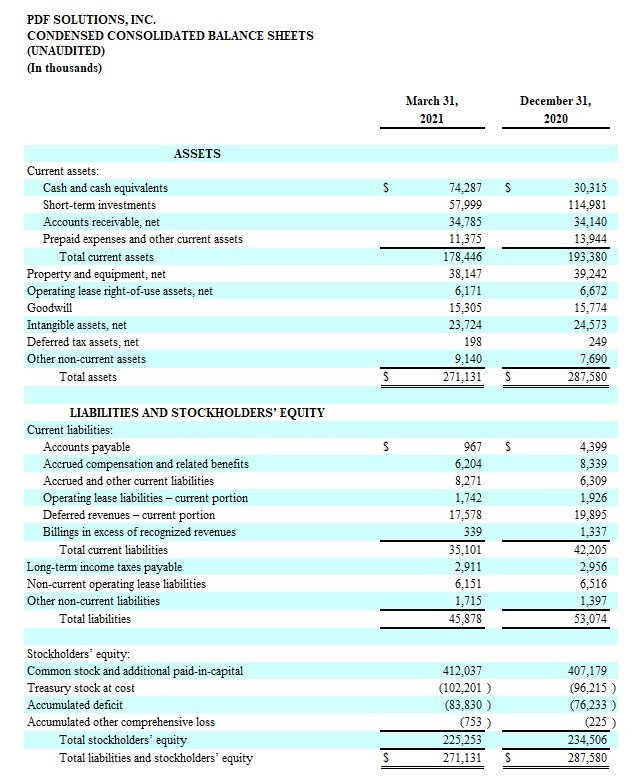

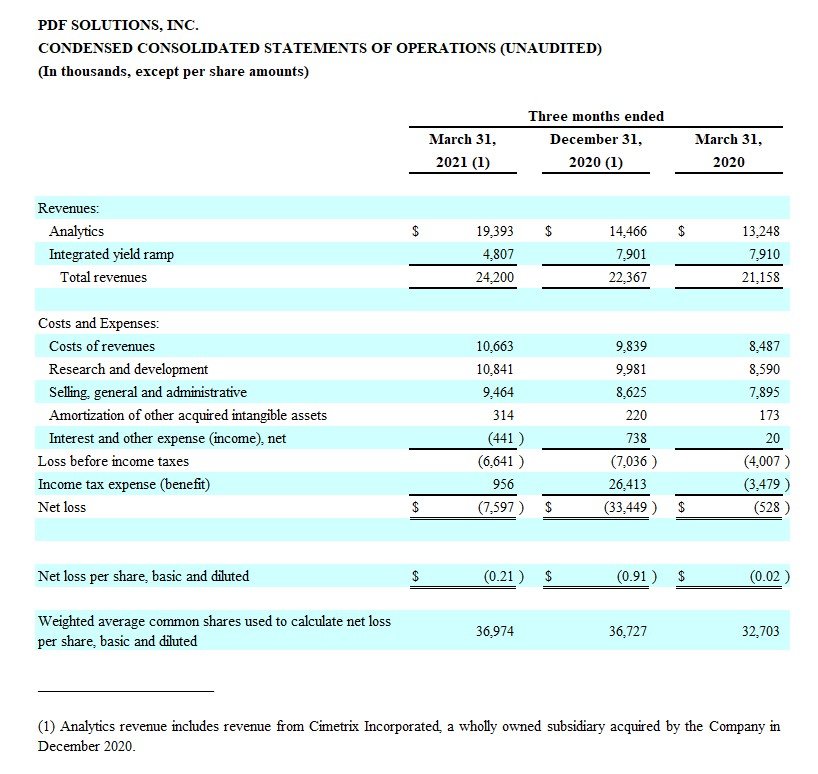

2021年第1四半期の総収入は2,420万ドルで、2020年第4四半期は2,240万ドル、2020年第1四半期は2,120万ドルであった。2021年第1四半期のアナリティクス収益は1,940万ドルで、2020年第4四半期は1,450万ドル、2020年第1四半期は1,330万ドルであった。2021年第1四半期のIntegrated Yield Rampの売上は480万ドルで、2020年第4四半期と第1四半期はともに790万ドルであった。

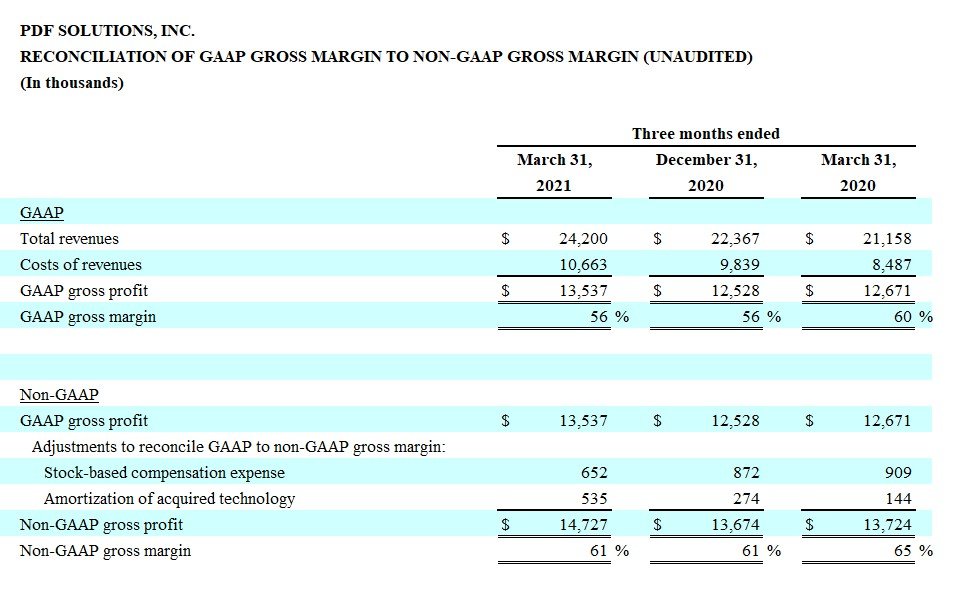

2021年第1四半期のGAAPベースの粗利益率は56%で、2020年第4四半期は56%、2020年第1四半期は60%であった。

2021年第1四半期の非GAAPベースの粗利益率は61%で、2020年第4四半期は65%であった。

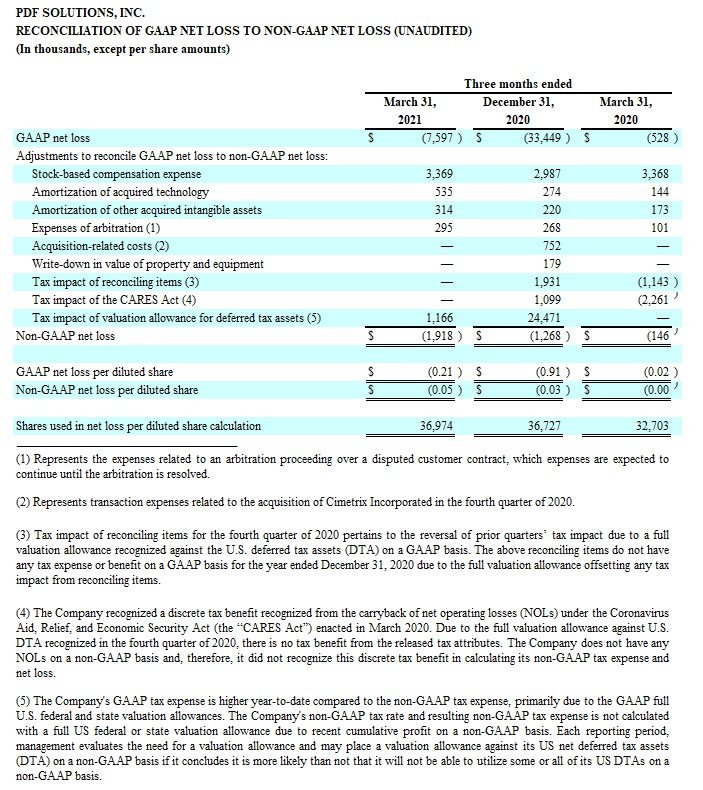

GAAP基準の2021年第1四半期の純損失は760万ドル(基本的および希薄化後1株当たり(0.21ドル))で、これに対して2020年第4四半期の純損失は3,340万ドル(基本的および希薄化後1株当たり(0.91ドル))、2020年第1四半期の純損失は050万ドル(基本的および希薄化後1株当たり(0.02ドル))であった。

2021年度第1四半期のNon-GAAPベースの純損失は190万ドル(希薄化後1株当たり(0.05ドル))であり、これに対して2020年度第4四半期の純損失は130万ドル(希薄化後1株当たり(0.03ドル))であり、2020年度第1四半期の純損失は110万ドル(希薄化後1株当たり(0.00ドル))であった。

2021年3月31日現在の現金、現金同等物および短期投資は1億3,230万ドルで、2020年12月31日時点の1億4,530万ドルから1,300万ドル減少した。2021年3月31日に終了した3ヶ月間に営業活動に使用した現金は830万ドル、自社株買いは450万ドルであった。

電話会議

すでに発表したとおり、PDF Solutions は本日午後 2 時(太平洋標準時)/午後 5 時(東部標準時)から始まるライブの電話会議でこの業績について説明します。この電話会議はPDFソリューションズのウェブサイト(http://ir.pdf.com/webcasts)でも同時にウェブキャストされます。ウェブキャストの再放送は、ライブコールの終了後約2時間以降、同ウェブサイトのアドレスでご覧いただけます。特定の非 GAAP 財務指標の開示と比較可能な GAAP 指標への調整を含む本プレスリリースのコピーは、PDF ソリューションズの経営陣が投資家やアナリストと財務結果について議論する際に定期的に使用する可能性のある非 GAAP 指標も含め、本リリースの日付後、PDF ソリューションズのウェブサイト https://www.pdf.com/press-releases で入手できます。

2021年第1四半期財務コメンタリーをオンラインで公開

当社の2021年第1四半期決算をレビューする経営報告書は、Form 8-Kにて証券取引委員会に提出され、当社ウェブサイト(http://ir.pdf.com/financial-reports)に掲載されます。アナリストおよび投資家の皆様は、電話会議に参加される前に、この解説をご覧になることをお勧めします。

非GAAP財務指標の使用に関する情報

米国で一般に認められた会計原則(GAAP)に従って決定された結果を提供することに加え、PDF ソリューションズは特定の非 GAAP 財務指標も提供しています。非GAAPベースの売上総利益率には、株式報酬費用と買収技術の償却費は含まれていません。非GAAPベースの純損失は、非経常的項目(係争中の顧客との契約に関する仲裁手続きに関連する費用を含む)、買収関連費用、有形固定資産の価値評価減、株式報酬費用、買収した技術およびその他の買収した無形資産の償却、および該当する場合はそれらに関連する法人税効果の影響、ならびに法人税の非現金部分、CARES法の税効果、繰延税金資産の評価引当金の調整を除外しています。これらの非GAAP財務指標は、当社の収益性と業績を測定するために経営陣が社内で使用しています。PDFソリューションズの経営陣は、これらの非GAAP指標は、(特定の非経常的項目および買収関連費用を除き)これらの費用のカテゴリーがいずれも将来の現金の使用に現在の影響を与えるものではなく、現在または将来の収益の創出に影響を与えるものでもないという事実を考慮し、当社の継続的な事業に関して投資家に有用な補足情報を提供すると考えています。これらの非GAAPベースの業績は、GAAPベースの財務情報の代替または代用とみなされるべきではなく、他社が使用する同様の名称の非GAAPベースの指標とは異なる場合があります。特に、これらの非GAAPベースの財務指標は、業績の指標としてのGAAPベースの損益指標や、流動性の指標としての営業活動、投資活動、財務活動によるキャッシュ・フローに代わるものではありません。経営陣は収益性と業績を測定するためにこれらの非GAAP財務指標を社内で使用しているため、PDF Solutionsは投資家に経営陣が見た当社の財務結果をご覧いただく機会を提供するために、これらの非GAAP指標を含めています。比較可能なGAAP財務指標と非GAAP財務指標との調整は、以下に示す当社の財務諸表の末尾に記載されている。

将来の見通しに関する記述

本プレスリリースおよび予定されている電話会議には、アナリティクスおよび総収益の予想を含む、当社が将来期待される業績および財務結果に関する将来見通しに関する記述が含まれている場合がありますが、これらは将来の出来事や状況により影響を受けます。実際の結果は、これらの将来見通しに関する記述に示されたものとは大きく異なる可能性があります。結果が大きく異なる原因となりうるリスクと不確実性には、以下のようなリスクが含まれます:ゲインシェア・ロイヤルティを提供する契約に基づく顧客の生産量、新製品開発のコストおよびスケジュール、新規および既存顧客による当社ソリューションの継続的採用、プロジェクトのマイルストーンまたは遅延および達成された業績基準、最終契約締結前の技術およびサービスの提供、コロナウイルス(COVID-19)が半導体業界および当社の事業または当社製品に対する需要に及ぼす継続的な影響;アドバンテストとの提携を含む当社の戦略的成長機会および提携の成功に必要な当社の経営陣の時間および関連費用、買収した事業および技術の統合を成功させる当社の能力、ならびにPDFソリューションズが米国証券取引委員会に定期的に提出するその他のリスク(直近で提出した2020年12月31日終了年度の年次報告書(Form 10-K)、四半期報告書(Form 10-Q)、最新報告書(Form 8-K)およびその修正報告書を含むがこれらに限定されない)に記載されているリスク。カンファレンス・コールで述べられた将来予想に関する記述は、本書の日付現在においてなされたものであり、PDF ソリューションズは、そのような記述を更新する義務や、実際の結果がそのような記述で予測されたものと大きく異なる可能性がある理由を負うものではありません。

PDFソリューションについて

PDF Solutions (NASDAQ: PDFS) は、半導体エコシステム全体において、製品の歩留まりと品質を向上させ、業務効率を高めて収益性を向上させるための包括的なデータソリューションを提供しています。同社の製品とサービスは、フォーチュン500社に名を連ねる半導体エコシステム企業各社に採用され、機器の接続と制御、製造およびテスト作業中に生成されるデータの収集、高度な分析と機械学習の実行により、スマート製造の目標を達成し、収益性の高い大量生産を可能にしています。

1991年に設立されたPDF Solutions社は、カリフォルニア州サンタクララに本社を置き、北米、ヨーロッパ、アジアで事業を展開しています。同社は(直接または複数の子会社を通じて)SEMI、INEMI、TPCA、IPC、OPC Foundation、DMDIIの正会員です。PDFソリューションズの最新ニュースや情報、オフィスの所在地については、https://www.pdf.com/。

PDF Solutions および PDF Solutions のロゴは、PDF Solutions, Inc またはその子会社の商標または登録商標です。

.

.

会社の連絡先

アドナン・ラザ

最高財務責任者

電話: (408) 516-0237

Eメール [email protected]

ソニア・セゴビア

IRコーディネーター

電話:(408) 938-6491

Eメール [電子メールは保護されています]

ジョー・ディアス, ロバート・ブラム, ジョー・ドラメ

ライサム・パートナーズLLC

電話: (602) 889-9700

Eメール [email protected]